The forest property market has seen several prosperous years of brisk trade and sharply rising price levels of forest land. However, the increased interest rates and the general market conditions have now changed the situation The end of zero interest rates in the spring of 2022 was reflected in the forest property market with a one-year lag, as forest funds and investment companies’ demand for forestland properties waned.

In 2023, there were 1,707 publicly traded forest property transactions of over 10 hectares. This represents a decrease of 7.1 % compared to 2022 and 10.9 % less than the average of the previous five years. Transaction volumes were close to average in the first half of the year but declined in the latter half and especially in November and December.

The low transaction volumes are not to be blamed on lack of supply, as last year saw 2,299 forest land properties of over 10 hectares put up for sale in the public market, the highest number during our observation period starting from 2016, and 7.3 % more than in 2022.

“Although the market volume decreased significantly nationwide, transactions in Southern Finland increased by 13.5 % compared to the previous year. This southward shift in market weight also affects the average market prices per hectare and per cubic meter, as forest land and timber volumes in the south fetch significantly higher prices than in the north,” says Eero Viitanen, Head of Analytics and Asset Intelligence at Forestland Investment Finland Ltd.. “It’s more worthwhile to measure changes in market price levels through a market price index adjusted for regional and characteristic changes rather than using average hectare prices.”

Price level trend turned downward, professional demand declined

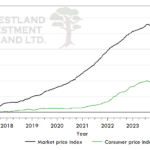

The Market Price Index, created and produced by Forestland Investment Finland, has risen by an average of 5.8 % per year over the last five years, with the steepest increase of 11.0 % in 2021. The long-standing upward trend in prices was interrupted in August 2023, although the annual market price level in 2023 was still 0.5 % higher than the previous year. The price level has decreased the most in Southern Finland, 2.4 % compared to the previous year, while in Lapland the Index rose by as much as 8.4 %. The divergent trend in Lapland is largely due to the thin market and declined transaction volumes in the region.

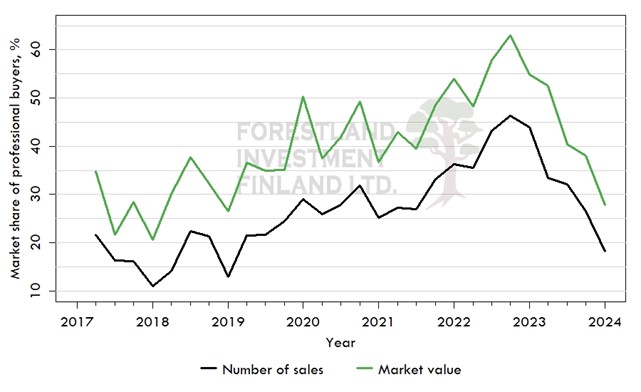

Professional buyers, such as forest funds and investment companies, have been significant players in the forest property market in recent years. At their peak, in the third quarter of 2022, they acquired 46 % of all publicly traded properties and 63 % of market value (Figure 1). In the last quarter of 2023, professional buyers accounted for only 18 % of transactions and 28 % market value, the lowest shares since the end of 2018.

“The decrease in price level is emphasized on the more valuable properties, as professionals tend to target particularly these larger-scale properties,” says Viitanen.

“However, it now appears that the peak in interest rates has passed while inflation approaches the ECB’s target. The average real return expectation of 4 % for forest investment is starting to look attractive again for those who appreciate diversification benefits,” anticipates Mika Venho, entrepreneur at Forestland Investment Finland.

Figure. Development of market share of professional buyers in number of sales and market value.

FACT BOX:

Forestland Investment Finland Ltd

Founded in Joensuu, Finland, in 2013, Forestland Investment Finland Ltd (FIF) is the leading expert of forestland property market in Finland. The company provides a full range of forestland property business solutions for both private and institutional forest investors.

FIF monitors continuously and meticulously the forestland property market in Finland. FIF publishes Market Price Index that measures the performance of Finnish forestland property market. The Index is based on the sales comparison approach (SCA).