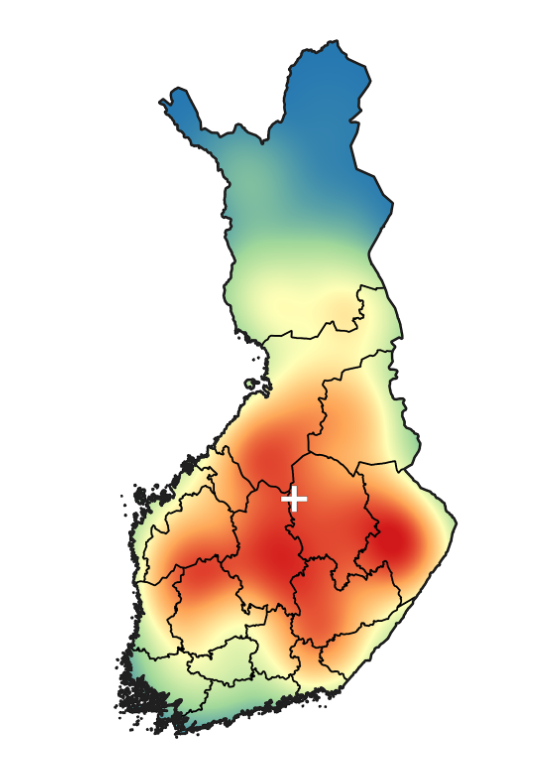

In 2022, fewer forest property sales were made than the previous year in the whole country, but especially in northern part of Finland. Measured in euros, however, the market grew elsewhere except in the northernmost part of the country, Lapland. The average size of a sold property was 35 hectares and the market value was 158,000 euros.

The statistics of Forestland Investment Finland Ltd (FIF) and the purchase price statistics of the Land Survey of Finland show that the forestland property market, which had accelerated in recent years, calmed down in 2022. This was particularly visible in the market volume of sold properties, which fell by nine percent across the country.

“The general economic uncertainty and the rise in interest rates started to curb the long-standing and very strong demand for forestland properties. Also, the availability of the properties for sale decreased slightly in 2022,” says Eero Viitanen, Head of Analytics and Asset Intelligence at Forestland Investment Finland.

Figure 1. Heatmap visualization illustrating sales activity of forestland properties in different areas in Finland in 2022.

Prices increased but more patiently than before

Although the number of sales decreased, the total value of the properties sold increased by 18 percent throughout the country. Looking at large areas, the market decreased only in Lapland. The market grew the most in Southern Finland, 29 percent.

“On average, the properties sold in 2022 had eight percent more timber volume than those sold the previous year. This in turn increased the amount of euros. On the properties that were sold in 2022, the volume of the standing timber was an average of 102 cubic meters per hectare,” says Viitanen.

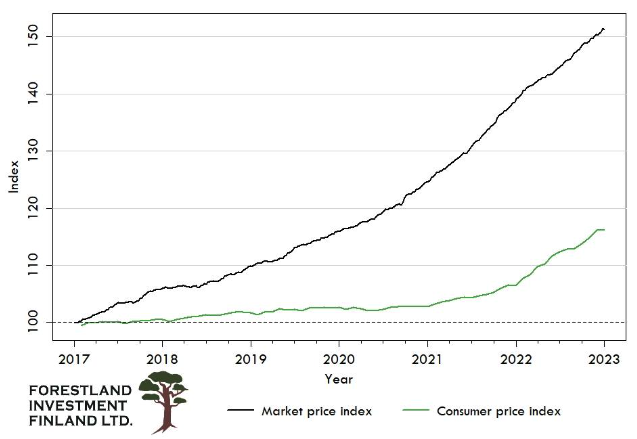

FIF’s market price index, which describes the change in the price level of forestland properties, continued to rise in 2022, but more calmly than the previous year. In 2021, prices rose record-breakingly fast, nearly 11 percent.

“During 2022, the price level increased by 8.3 percent throughout the country. In Central Finland, the rise continued at a rate of slightly less than ten percent. In Lapland, the increase was only 4.6 percent.”

Figure 2. Development of the forestland Market Price Index (MPI) 2017 – 2021.

Professional investors were active

Viitanen estimates that the uncertainty of the market especially affected the activity and interest of non-professional buyers of forestland.

The assessment is supported by the fact that professional forest investors were more active in the market than before. Professional forest investors include forest funds, investment companies and professionally managed and expanding joint forests.

“Professional buyers’ share of the number of sales increased during the year to 43 percent throughout the country, and up to 56 percent when measured in euros. The share was the largest in Central Finland, about half of the number of sales and as much as 66 percent of the value of the sales,” says Viitanen.

Viitanen says that in recent years, prices for timber, which have risen more than inflation, have supported the positive price development of forestland properties. He sees that the calm rise in forestland prices will bring stability to the market.

“Sellers as well as buyers have no reason to worry. The slowing down of price increases is a good thing for all operators. The good thing for sellers is that the prices are still high, but the possible sale of the property no longer needs to be postponed in the hope of a drastic price increase.”

FACT BOX:

Forestland Investment Finland Ltd

Founded in Joensuu, Finland, in 2013, Forestland Investment Finland Ltd (FIF) is the leading expert of forestland property market in Finland. The company provides a full range of forestland property business solutions for both private and institutional forest investors.

FIF monitors continuously and meticulously the forestland property market in Finland. FIF publishes Market Price Index that measures the performance of Finnish forestland property market. The Index is based on the sales comparison approach (SCA).