Total returns in private Finnish forest investments fell short of the average of previous years in 2023

The total return on private forests in 2023, at 3.9%, fell far short of the average of previous years. The reason for this decline was the Finnish forestland property markets price development, which was more moderate than in the previous years.

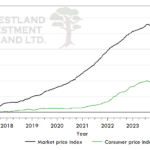

The total return on forest investment in private forests, calculated by Forestland Investment Finland Ltd, includes the operating profit and net value growth obtained from the Natural Resources Institute Finland, in addition to changes in the market price level of forestland properties. In 2022, the total return was 12.3%, and the seven-year average was 10.3%. Last year, the increase in market price levels contributed only 0.7 percentage points to the total return, whereas previously, it accounted for more than half of the total return. The shares of more stable return factors, operating profit and net value growth, in the 2023 total return were 2.4% and 0.8%, respectively.

“The strong rise in market price levels that lasted for years leveled off in 2023, without however turning negative on an annual basis,” says Eero Viitanen, Forestland Investment Finland Ltd’s Head of Analytics and Asset Intelligence. “The operating profit of forestry and net value growth are interconnected; when more timber is harvested annually, the operating profit of forestry increases, and net value growth decreases. Changes in stumpage prices also affect the operating profit.”

Components of Total Return on Forest Investment

The operating profit from forestry represents the monetary yield from timber production, taking into account timber sales revenue, forest management and administrative costs, and government subsidies. The net value growth considers growth, harvesting, and the development of pulpwood-% and sawlog-%. Market prices of forestland properties are needed for returns relative to capital, and changes in market price levels are measured by the Forestland Investment Finland Market Price Index.

“When assessing the total returns, it is important to remember that the data covers the whole of Finland, including both actively and passively managed forestland properties,” reminds Mika Venho, founder and entrepreneur of Forestland Investment Finland Ltd.

Natural Resources Institute Finland’s Data Under Review

As part of the Natural Resources Institute Finland’s savings measures, the statistics underlying the calculation of total return, namely Forest as an Investment Class and Operating Profit of Private Forestry, are apparently being discontinued. Therefore, these figures describing the total return on forest investment for 2023 may be the last, at least calculated in the current way.

Learn more about our Market and Asset Intelligence HERE.

FACT BOX:

Forestland Investment Finland Ltd

Founded in Joensuu, Finland, in 2013, Forestland Investment Finland Ltd (FIF) is the leading expert of forestland property market in Finland. The company provides a full range of forestland property business solutions for both private and institutional forest investors.

FIF monitors continuously and meticulously the forestland property market in Finland. FIF publishes Market Price Index that measures the performance of Finnish forestland property market. The Index is based on the sales comparison approach (SCA).